Content

Online bookkeeping services often provide a comprehensive solution that covers all of these criteria. It’s important to take the time to research different options and identify which service best meets your unique needs. Consider whether you need assistance with managing cash flow, sales tax, payroll, income, or other financial aspects of your business. Outsourced https://www.digitalconnectmag.com/a-deep-dive-into-law-firm-bookkeeping/ bookkeeping services are another option and typically charge monthly fees starting at $99 per month. This can be a more cost-effective solution for small businesses with basic bookkeeping needs. Additionally, many accounting software providers offer free trials for their basic services, which can be sufficient for managing your bookkeeping needs.

My stress levels were at about 10% of what they had been, and money was flooding the bank account. Instead, I sat down and examined the income statement in detail and discovered I could fire most of our clients, downsize the staff, and make a lot more money. More importantly, it gets you on the path to transform your business into a money-making beast. The chart of accounts lists every account the business needs and should have.

How to handle sales tax in ecommerce bookkeeping

By this stage, you’ll have set up all your financial accounts and chosen a bookkeeping method. With cash accounting, you record your transaction when cash changes hands. But with accrual accounting, you will record purchases or sales immediately, even if the money does not change its hands. Sometimes, firms start their business with cash accounting and switch to accrual accounting once they grow.

You can’t make adjustments and improvements to increase profit margins and productivity without having a clear idea of what’s going on with your money. Below is a list of the key things you need to understand to have a good grasp on your business finances and ensure your business is moving in the right direction. At NorthOne, we know our customers didn’t get into business because they are passionate about accounting. However, like it or not you can’t have a successful business without understanding how your business is financially performing. In this article we’ll be breaking down the basics of what you need to know about bookkeeping to ensure long term success for your business.

Bookkeeping Mistakes to Avoid

If you’re struggling with getting started with your bookkeeping, don’t keep struggle on your own. Although you don’t have to be an accountant to master bookkeeping basics, it can still be challenging — especially for a more complex business. Following the bookkeeping basics above will make the process easier and help you to stay compliant with industry standards. Bookkeeping is all about the process of recording and showing a balance between your incoming and outgoing money.

Staying on top of these expenses is a core part of managing finances to strategically maintain and ultimately grow your business in good financial health. Bookkeeping is the recording of a business’s financial transactions with financial implications that need to be recorded. Whether you take on your small-business bookkeeping yourself or end up outsourcing to an expert, understanding the basics will help you better manage your finances. You’ll save time chasing receipts, protect yourself from costly errors, and gain valuable insights into your business’s potential. At least once a week, record all financial transactions, including incoming invoices, bill payments, sales, and purchases. You may do this every month, but at the very least, balance and close your books every quarter.

CFO Consulting Services: Expert Advice for Your Business Finances

With their expertise and guidance, you can make informed decisions that will help you achieve your business goals while minimizing financial risks. The tax filing deadline is an important date that should not be overlooked. To avoid penalties and interest charges, be sure to file your tax return on time or request an extension and pay any taxes owed by the original deadline. If you have any questions or concerns about your tax situation, be sure to consult with a tax professional. If you’re unable to file your tax return by the deadline, you can request an extension by filing Form 4868. This form gives you an additional six months to file your tax return, but it doesn’t extend the deadline for paying any taxes owed.

Balance Pro is available on the App Store, Google Play, and on the web. PayPal provides a simple and convenient way to track all your transactions, and it also allows you to print receipts for your records. Navigating Law Firm Bookkeeping: Exploring Industry-Specific Insights In this article, we will guide you on how to print a receipt from PayPal. N this article, you will discover some of the best expense report apps and their advantages, as well as free options.

Double-entry bookkeeping requires more effort and time to maintain but is more accurate than single-entry bookkeeping. Double-entry bookkeeping involves recording financial transactions in two ledgers, called the “debit” and “credit” sides. Each transaction must be recorded on both ledgers so that any changes made to one ledger will be reflected in the other.

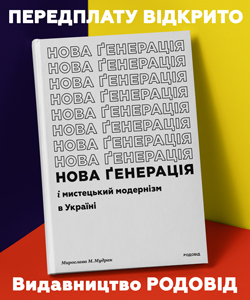

Найкращий лайк — це 30 гривень))

Фондуючи незалежну редакцію Читомо, ви допомагаєте зростити нове покоління професіоналів видавничої справи і збільшуєте кількість хороших книжок у світі.

Спасибі.

|

Щоб залишити свій коментар, будь ласка, увійдіть через аккаунт Vkontakte чи Facebook