Concurrently, i’ve a small grouping of benefits which have expertise in rules, administration, and you can income tax consultancy to perform all facets linked to fees along with your condition along with your family nation. Paraguay now offers a course that allows individuals to get long lasting residency quickly from the qualifying while the traders who will render a job and funding on the nation. This is a permanent proper, nevertheless data must be revived all 10 years. Simultaneously, there is absolutely no requirement for carried on exposure in the united states in order to care for it right.

Find A favourite $5 Put Casino Bonus | 40 Super Hot $1 deposit

It is recommended that landlords tend to be conditions in the book requiring tenants to thoroughly clean the unit before moving out. It may also getting helpful to post a change-out listing of everything that needs to be removed, as well as the cost per item should your property manager has to brush otherwise resolve the object rather. Any experience that could lead to withholding a security put or terminating the fresh rent might be in depth in the rental contract. Get together a safety put is not required for legal reasons, however it may help include landlords economically if a renter leaves all of a sudden without paying lease or causes assets wreck.

Exactly how much security deposit is landlords costs?

- To have information on the requirements for it exemption, see Bar.

- Possessions professionals may only subtract from a citizen’s security put to cover destroy-relevant will cost you (you to definitely exceed typical deterioration) if your citizen has failed to adhere to particular personal debt.

- We think individuals will be able to create monetary choices that have confidence.

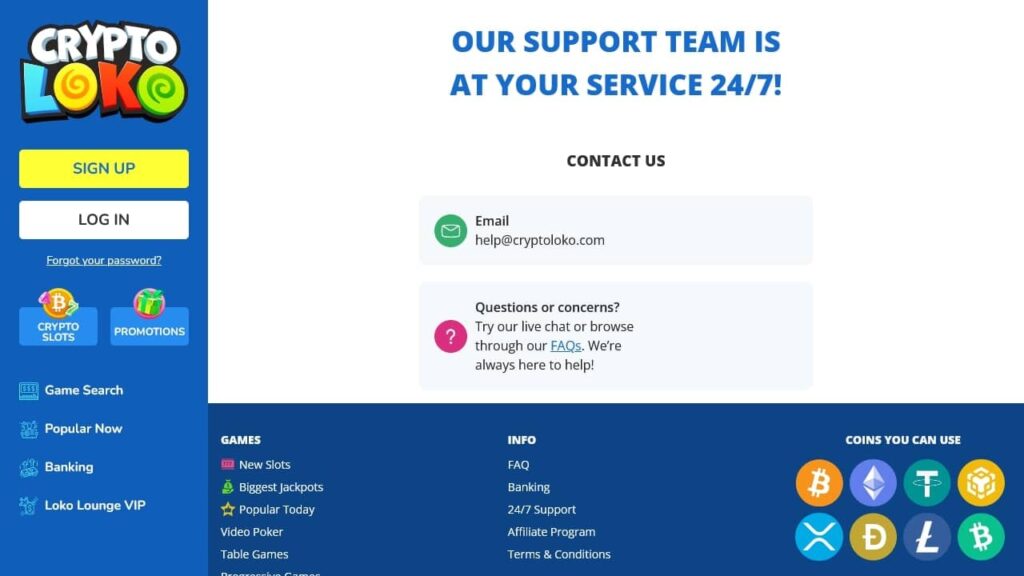

- They are also highly regarded by the united states due to their solid reputation and licensing and a track record of taking care of their people including better.

- Ca law will not comply with which expansion from PPP eligibility.

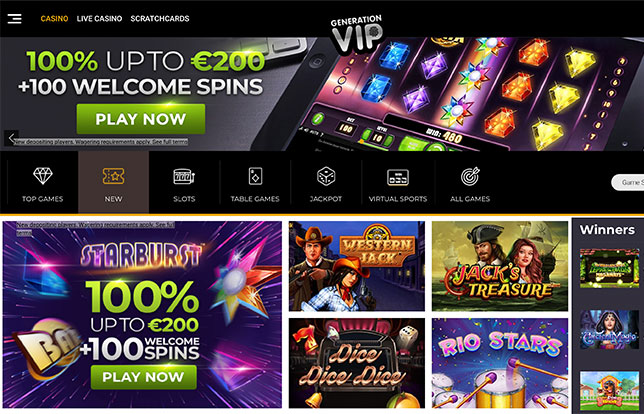

The brand new star names one to appear all over is actually well-known, because of the brand, yet not also Shannon Sharpe can also be prevent the football casino player of effective larger to your system. FanDuel Sportsbook regularly offers wager increases to own huge online game composed of props 40 Super Hot $1 deposit and you may parlays having boosted possibility. Enthusiasts with a couch potato rooting need for the fresh given groups playing within the a game title, don’t proper care, the brand new FanDuel Sportsbook application have your protected. Over/below totals might possibly be several of your favorite sports betting lines, while they combine the brand new rating away from each other groups in the online game. As one example, in the event the a different bettor wagers $100 to the Gambling moneyline from the +180 chance, a fantastic choice manage return an excellent $180 funds.

In case your estate otherwise faith states a cards carryover to possess an expired credit, fool around with mode FTB 3540, Credit Carryover and you can Recapture Summary, to figure that it borrowing from the bank, until the brand new property or believe must over Plan P (541). Therefore, enter the quantity of the credit to the Schedule P (541), Parts A2 and B1 and do not install mode 3540. Go into one allowable desire repaid otherwise incurred that’s not deductible elsewhere to your Function 541. Attach another agenda demonstrating the interest paid back or obtain. Do not tend to be desire on the a debt that has been incurred otherwise proceeded to pick or carry financial obligation on what the newest attention try income tax-excused. If the outstanding interest stems from an associated person, get federal Guide 936, Home loan Interest Deduction, for more information.

The brand new trustee or borrower inside arms need to obtain a national company identification number (FEIN) to your bankruptcy property and employ it FEIN inside filing the brand new bankruptcy house income tax go back. The brand new societal protection matter (SSN) of the person can’t be utilized as the FEIN for the bankruptcy proceeding house. Concurrently, an annual certification away from a job is required when it comes to for every licensed full-time personnel hired inside the an earlier taxable seasons.

Shop, rating easy access to cash which have Charge debit

You are thought briefly within the united states despite the true length of time you are contained in the new United Claims. You can not exclude people days of presence in the united states beneath the after the points. When it comes to an individual who are evaluated psychologically inexperienced, proof intent to leave the usa will be computed by considering the individual’s pattern away from behavior prior to these were judged psychologically inexperienced.

Withholding to your Earnings

Although not, you may also make the choice by submitting Form 1040-X, Amended You.S. Private Income tax Come back. You must document an announcement on the Internal revenue service when you’re excluding to 10 times of presence in the united states for purposes of your abode doing day. You need to indication and you will time which report you need to include an affirmation that it’s generated less than penalties of perjury. The fresh statement have to hold the following the information (since the applicable). Ivan came to the us for the first time to the January 6, 2024, to attend a corporate appointment and you can gone back to Russia to the January ten, 2024.

Найкращий лайк — це 30 гривень))

Фондуючи незалежну редакцію Читомо, ви допомагаєте зростити нове покоління професіоналів видавничої справи і збільшуєте кількість хороших книжок у світі.

Спасибі.

|